Simplyfy transforms the lending journey with a seamless digital-first experience — delivering personalized loan rates, effortless document uploads, and real-time application tracking, so borrowers move from application to approval with speed, clarity, and confidence.

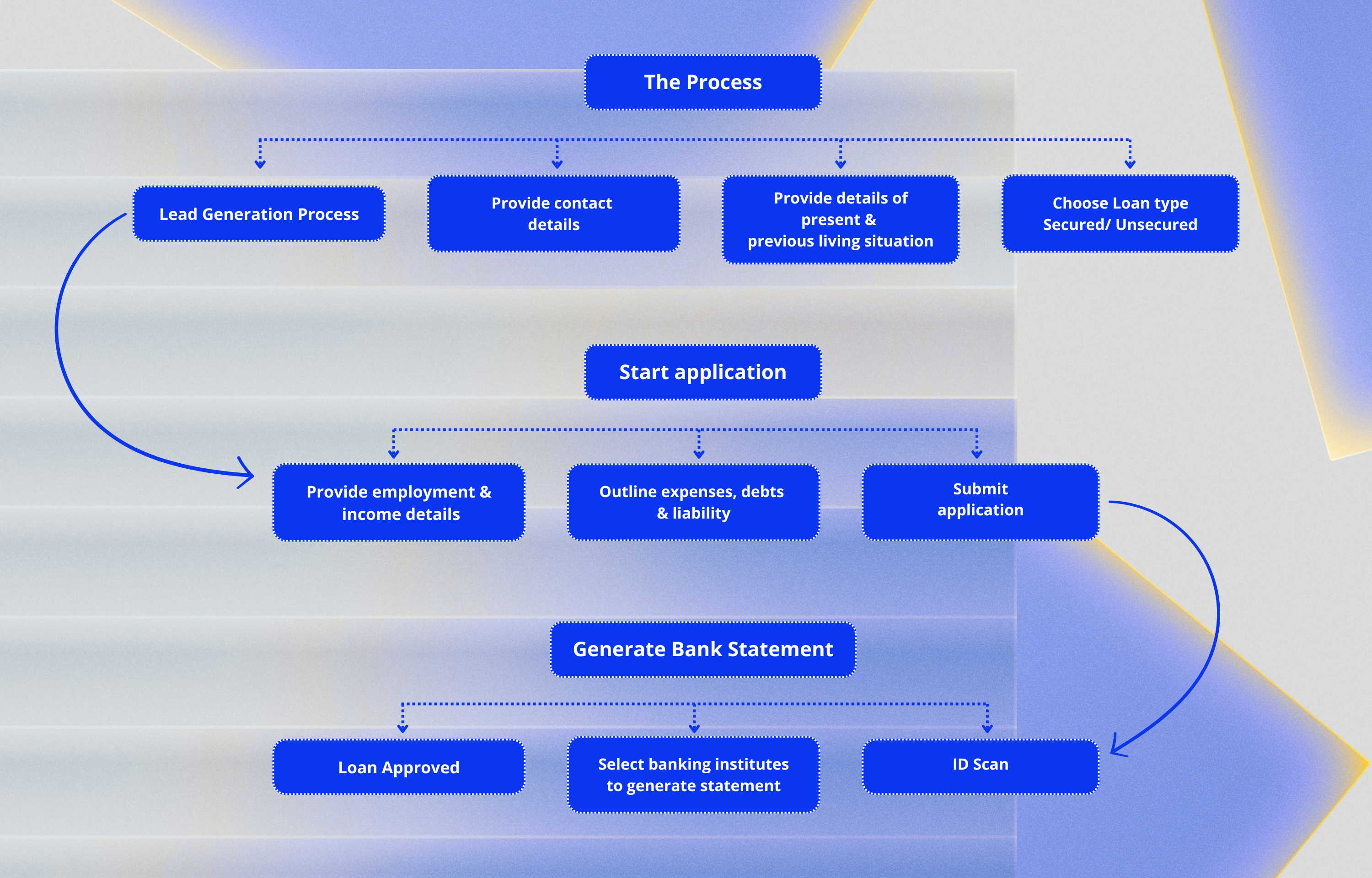

Simplyfy is a modern, user-friendly loan lending platform built for a renowned Australian FinTech company. It simplifies the entire lending lifecycle, from lead generation to loan settlement, with an intuitive, digital-first experience. The platform empowers users to get personalized loan rates, upload necessary documents, and track their applications in real-time.

If you want to visualize how your borrower’s journey can look with zero paperwork and instant validation, let’s map it together.

If you’re still juggling multiple tools or spreadsheets for lead tracking, origination, and KYC, let us help you design a single source of truth for your lending data.

Traditional lending processes were slow, involved multiple manual verifications, and caused significant drop-offs during the application stage. Users had to submit paper documents and wait for human verification, delaying approval times and impacting overall customer experience.

If you’re losing leads halfway through the funnel, let’s identify the biggest friction points and fix them with automation and better UX.

We built Simplyfy with a ReactJS-powered front end for smooth UX and Laravel in the backend for robust API orchestration. Key integrations included:

If compliance checks or bank statement collection are slowing your approvals, we’re here to show you how to automate these steps securely, without adding complexity.

If improving loan approval speed or reducing drop-offs is on your roadmap, we can share benchmarks and build you a path to similar results.

We don’t just create apps, we optimize conversion, automate compliance, and cut down approval cycles.

Get to Know Our ExpertiseArchitect digital lending journeys with instant KYC, zero paperwork, and real-time approval, all while boosting conversion and automating compliance at every step