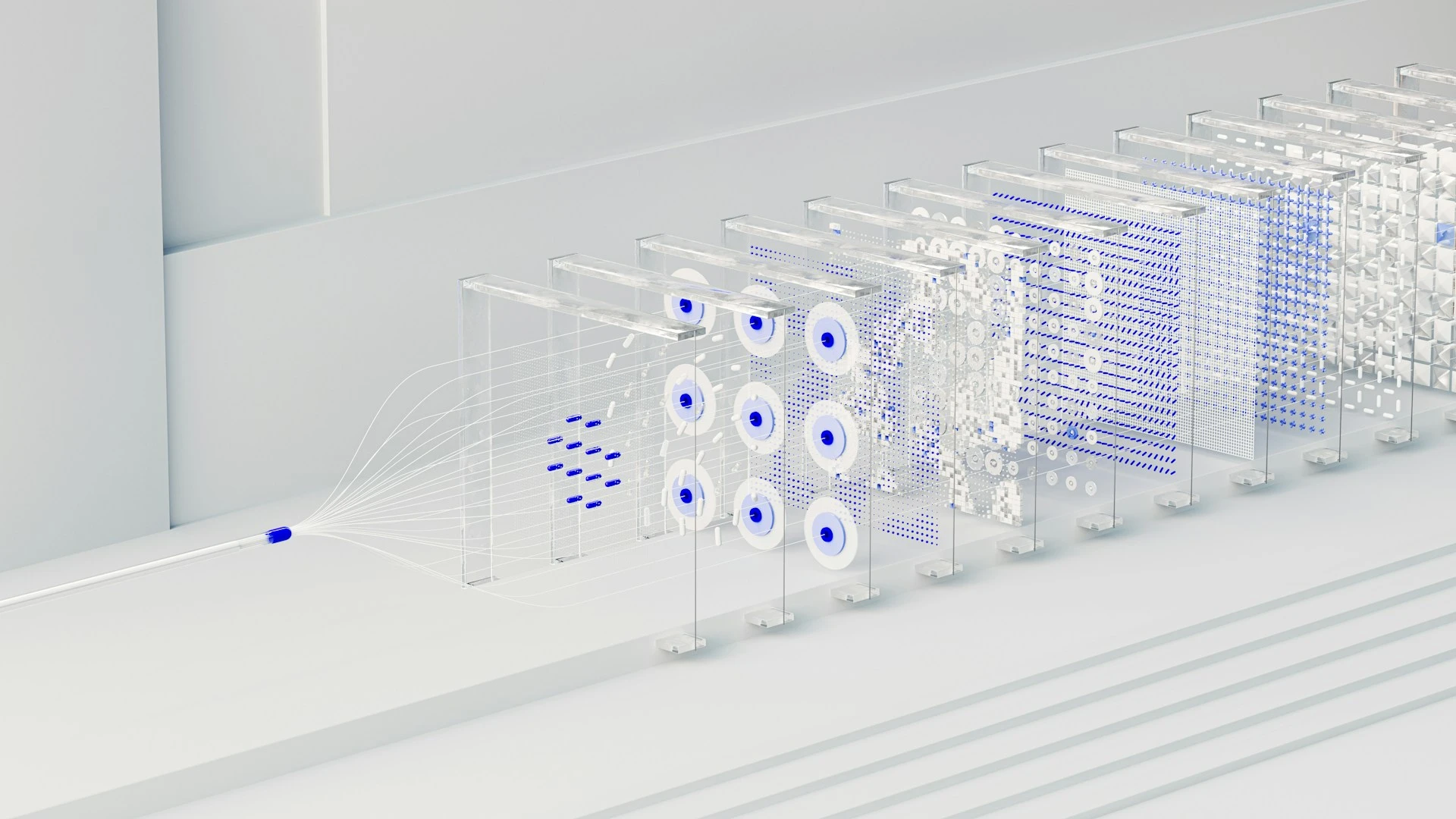

Connect payments, logistics, and platforms into one unified experience.

Multiple gateways with support for global and local options.

Real-time shipment tracking, returns, and last-mile delivery updates.

Sync catalogs, inventory, and pricing with Amazon, Flipkart, or eBay.

ERPs, CRMs, and tax systems connected for smooth operations.

Seamless payments, global reach.

Tech that drives smarter logistics.

Smart Business Management Tools.

No-BS coverage of real sync failures, manual fixes, and fragile connections widely discussed by ops, integration, and platform teams

Integrations often fail to keep data in sync, resulting in mismatched inventory across marketplaces, delayed or incorrect invoicing in ERPs, manual payment reconciliation, and ongoing firefighting for shipping updates or order status. We unify multiple payment gateways (Stripe, Razorpay, PayPal, Square) with an abstraction layer that normalizes payment methods, errors, and webhooks into a single checkout and reconciliation flow. This approach minimizes manual touchpoints, keeps data consistent across the ecosystem, and allows adding new tools or channels without constant rework or downtime.

Link payment gateways, finance, and ERP for instant reconciliation and cash flow visibility; automate everything from invoices to analytics, minimizing manual touchpoints.